Recent trends in the Henry Hub spot as well as futures prices have been monitored In the energy market. The Henry Hub spot price,which represents the current market value for natural gas, experienced a notable increase of .10 cents, rising from $2.51 per million British thermal units (MMBtu) on the previous Wednesday to reach $2.61/MMBtu as of July 27th. Additionally, the August 2023 NYMEX contract, which represents futures trading for natural gas delivery in August 2023, saw its price rise by 6.2 cents, going from $2.603/MMBtu last Wednesday to $2.665/MMBtu yesterday. Furthermore, the 12-month strip, which is an average of futures contracts spanning from August 2023 to July 2024, demonstrated a significant climb of 11.8 cents, settling at $3.259/MMBtu. This indicates an increase in demand or constraints of supply in the current market.

During the reporting week from Wednesday, July 19, to July 26, natural gas spot prices generally increased across major pricing hubs, excluding some areas like Appalachia and the Pacific Northwest. Price changes ranged from a decrease of $0.27/MMBtu at Tennessee Zone 4 Marcellus to an increase of $6.69/MMBtu at SoCal Citygate. In the Northeast, prices went up despite a slight rise in production and a decrease in weekly average consumption. For example, at the Algonquin Citygate serving Boston, prices increased significantly from $1.74/MMBtu last Wednesday to $6.31/MMBtu yesterday, driven by reduced operational capacity across the system. In New York, the Transcontinental Pipeline Zone 6 saw a price increase from $1.65/MMBtu to $2.10/MMBtu. In contrast, the Tennessee Zone 4 Marcellus spot price in Appalachia decreased from $1.35/MMBtu to $1.08/MMBtu. While total natural gas consumption in all sectors in the Northeast decreased by 1%week over week, daily consumption increased by 21% since Saturday. In the Western region, prices also increased, particularly in California. For instance, the price at PG&E Citygate in Northern California rose from $4.89/MMBtu to $5.29/MMBtu, while at SoCal Citygate in Southern California, it surged from $5.64/MMBtu to $12.33/MMBtu. Above-normal temperatures in California and the Desert Southwest contributed to consistent natural gas consumption levels.

Based on data from S&P Global Commodity Insights, the average total supply of natural gas in the United States saw a slight increase of 0.3% or 0.4 billion cubic feet per day (Bcf/d) week over week. This growth was primarily driven by a 0.3% rise in dry natural gas production, reaching an average of101.3 Bcf/d. Working natural gas stocks totaled 2,987 Bcf, which is 345 Bcf (13%) more than the five-year average and 573 Bcf (24%) more than last year at this time. Meanwhile, net imports from Canada remained relatively stable compared to the previous week, averaging 6.1 Bcf/d.

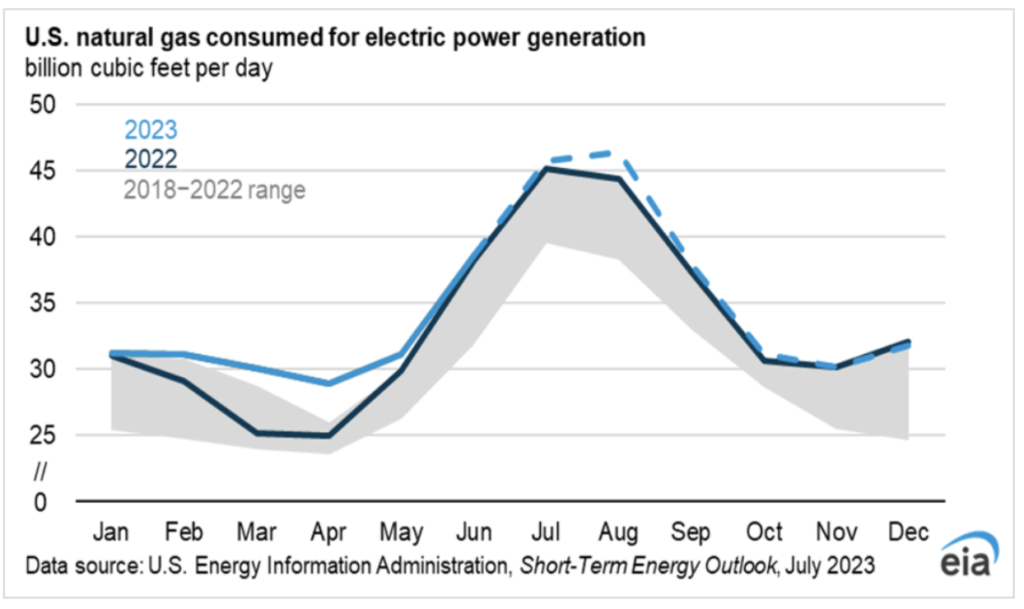

On the demand side, total U.S. consumption of natural gas experienced a decrease of 0.6% or 0.4 Bcf/d compared to the previous report week, averaging 75.9 Bcf/d, as reported by S&P Global Commodity Insights. Notably, natural gas consumed for power generation declined by 1.2% or 0.5 Bcf/d week over week. However, there were slight increases in other sectors, with industrial sector consumption rising by 0.4% or 0.1 Bcf/d, and combined residential and commercial sector consumption increasing by 0.4%, although it amounted to less than 0.1 Bcf/d in absolute terms.

In terms of exports, natural gas shipments to Mexico experienced a modest decline of 1.0% or 0.1 Bcf/d week over week, averaging 6.2 Bcf/d. On the other hand, deliveries to U.S. LNG export facilities (LNG pipeline receipts) held steady at an average of 12.6 Bcf/d, showing no significant change from the previous week. Overall, these supply and demand dynamics indicate some fluctuations in the natural gas market, with slight variations in both production and consumption. This impacted the overall supply-demand balance.

During the final week of July, power forwards for the 12-month strip remained stable with no significant changes and the NYISO UCAP also showed a steady status. However, concerns persist about the lack of liquidity in the New York City and Zone G, H, and I capacity markets, which have displayed signs of decreased liquidity levels. Notably, there was a considerable decline in PA solar RECs impacting the renewable energy market, while other classes of RECs remained relatively unaffected. In the Great Lakes Region, forward power prices experienced a slight decline over the past week, providing some relief from the warm temperatures in the area. On the other hand, natural gas prices in the Midwest remained steady, despite support from warm temperatures in the West.

Looking ahead to 2024-2028. Forward power prices in the Mid-continent region mostly stayed unchanged or experienced minor increases of approximately +1%. However, it’s important to note that the entire strip currently stands significantly lower, at -21% below the all-time high price average. Specifically, the 2024 term exhibited a more substantial decrease of -26%, while the 2026-2028 term is -19% lower than previous levels. These price declines can be attributed to factors such as reduced demand and low spot gas prices, resulting in considerably lower index prices year-over-year. In the West Hub, the average monthly settlement price for July showed a rise to $33.62/MWh, marking a notable +22% increase compared to June’s closing price. However, it’s important to highlight that this still represents a substantial -56% decrease compared to July of the previous year. Meanwhile, in the Eastern Hub, the month- to-date settlement average price currently stands at $40.21/MWh, reflecting a significant +113% increase compared to June. Nevertheless, it remains substantially lower, at -67%, compared to July of last year.

We predict that the Henry Hub spot price will continue its upward trend throughout the year. U.S. dry natural gas production has remained relatively steady in recent months and we expect this trend to continue for the rest of the year. However, with an increase in natural gas consumption compared to the previous year, we anticipate that U.S. natural gas inventories will decrease the surplus to the five-year average leading to upward pressure on prices. As of the end of June, storage inventories stood at 2,900 billion cubic feet (Bcf), which is 14% above the five-year average. However, we expect storage inventories to reduce to 7% above the five-year average by the end of the injection season on October 31.

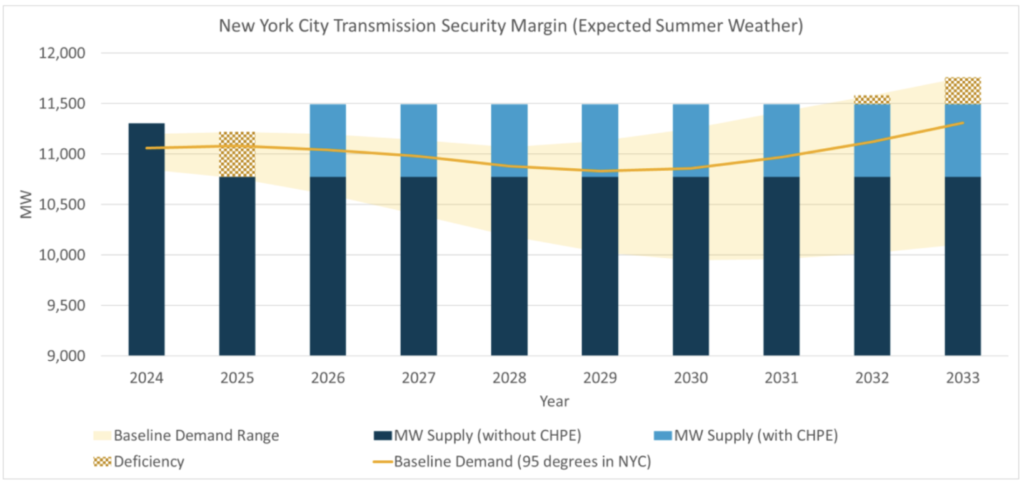

NYISO’s projections also indicate that New York City, the largest metropolis in the country, could face potential reliability challenges within the next two years. The issue stems from the emergence of beneficial electrification loads, which are driving up electricity demand. According to the ISO’s report, New York City’s J-zone is expected to experience a deficit of up to 446 MW during nine peak hours under anticipated weather conditions. This deficiency is attributed to transmission security, assessing the grid’s capacity to withstand disturbances. Factors contributing to the reliability gap include building electrification, electric vehicle charging, and the retirement of less environmentally friendly power generators used for peak demand. The introduction of new emissions limits by the New York State Department of Environmental Conservation in 2019 has further impacted the situation. The implementation of the emissions limits resulted in over 1 GW of peaking capacity being deactivated or limited by May 1, with an additional 590 MW expected to become unavailable from May 2025, all within New York City.

Furthermore, the state’s top public utility regulator has approved a rate hike for Con Edison gas and electricity bills in New York, which could result in bills more than doubling within the next two years. As part of the three-year rate plan, Con Ed will implement a substantial 9% rate increase across the city starting next month. An average resident using 600-kilowatt hours of electricity per month can expect their bill to surge by approximately $14.44 (9.1%) in August, followed by further increases of $7.20 (4.2%) in January next year and roughly $2.43 (1.4%) in January 2025.

The impact will also be felt by the utility’s gas customers. For a typical Con Ed customer using an average of 100 therms per month, their bill is estimated to increase by a significant $17.28 (8.4%) from next month, with additional increases of $14.90 (6.7%) in January and $15.61 (6.6%) the following year. This could potentially mean that a current monthly electricity and gas bill of $70 will double to just over $140 by 2025. Due to this situation, F&D Partners strongly advise all their clients to act promptly, as the current exceptionally low prices are unlikely to be repeated in the future.

F&D Partners was very successful in navigating one of the most volatile years in the energy markets by helping our clients save tremendously.

Contact us today for the newest strategies in the energy markets for 2023, 2024 and 2025.